Most likely foriegn films. Asian films release on DVD anywhere from months to years before the US release.Originally Posted by kisrum

They can be purchased legally from sources like Yesasia.

It took years for Shaolin Soccer to be released. And a very long time for Hero. Volcano High was bastardized with MTV voices a few years after it came out on Asian DVD.

I doubt piracy is the issue here. More like poor economy and high pricing.

+ Reply to Thread

Results 31 to 60 of 77

-

-

I'll bring this quote up from one of the articles I posted

.In fact 2005's box office returns mirror 2004's very closely, and box office receipts are down just six per cent this year. One more blockbuster would have turned the slump into a boom.

So are they really hurting or just claiming so so they will be allowed more intervention and leeway on filesharing and new technology? -

the current budget for rebuilding New Orleans alone is 62 billion. That enough "help" for ya?well heres one,the new upcoming superman movie,has a budget of $250 million.---an exhorbitant amount if ever there was one..hell,they cant help people after a storm,but $250 million for a movie-methinks theres dumb logic there.

-

http://www.cursor.org/Originally Posted by kisrum

A New York Times analysis reveals that "well-off neighborhoods ... have received 47 percent" of the post-Katrina home loan approvals from the federal government's main disaster recovery program, while "poverty-stricken ones have gotten 7 percent."

Now let us stop the politicing before a lockdown. -

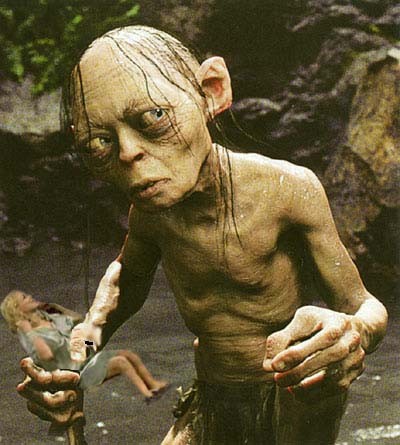

King Kong --- Is it just me or does this film look like Peter Jackson is just reusing some of the same Gollum motion models in a fur suit texture? I haven't seen the film but the promos seem to have unnatural low rent jerky animation motion.

A cool cult film may be King Kong re-rendered with Gollum as the beast.Recommends: Kiva.org - Loans that change lives.

http://www.kiva.org/about -

We have one close by that's still open, actually reopened. It's dirt cheap too. Last tie I was there it was around $10 a car load. Food was cheap too, slightly more than what you'd ecpect to pay at a fast food joint. First run films too, different one each week.Originally Posted by somebodeez

To saym the least the place is packed nightly in the summer. -

Movies watched in a theater this year - 1 - the new Harry Potter - I thoroughly enjoyed it. We went to the matinee - the 2 movie tickets were cheaper than the 1 large popcorn & 1 medium lemonade.

There have been other releases I considered seeing in a theater - but given the fact that these show up on dvd in such a short time, I surely did not have a sense of urgency to rush to the movie theater. So, I guess for me, my reduced visits to movie theaters is mostly due to a competing format of entertainment - the dvd. And I can watch it whenever I want in the comfort of my home. If I get tired watching it - I can pick up where I left off later. And if you shop wisely, the cost for 1 dvd is almost always less than 2 tickets to the theater.

My purchases of dvd's are decreasing - mostly because I already have too many (just ask my wife), and most of what comes out is not worth buying. And now that dvd's go on sale around here for well below $10 eventually, what's the rush to buy new releases that usually turn out to be garbage? -

Taegukgi cost 12,8 mil

Its blows just about every Hollywood movie made lately out of the water.

I like the crisis that isn't article.

My 2 cents: The Internet does not only allow for rapid spread of pirated movies it also allows for rapid spread of "word of mouth", so markteting can't trick people into watching crappy movies as well as it used to. -

Neroon

People forget about Blair Witch as a money maker.

Isn't there a Neil Gaiman movie done with off the shelf video products?

I have to agree with the word of mouth thing.

People always buy the dvd's and cd's they want to keep. And they want to keep good product. Isn't that why there is a Criterion line and a Hong Kong Legends line.

From looking at this Top grossing list

http://movieweb.com/movies/box_office/alltime.php

I see that most of the movies were fairly recent.

Compare that with the biggest profit making films

http://www.the-numbers.com/movies/records/budgets.html

These are just the most profitable.

Interesting no?Most Profitable Movies, Based on Return on Investment Release Date Movie Distributor Budget Worldwide Gross Percentage Return

1 7/14/1999 Blair Witch Project, The Artisan $35,000 $248,300,000 354,614.29%

2 10/6/2004 Tarnation WellSpring $218 $662,014 151,738.07%

3 5/7/2004 Super Size Me IDP/Sam Goldwyn $65,000 $17,705,863 13,519.89%

4 8/11/1973 American Graffiti $777,000 $140,000,000 8,909.01%

5 7/25/1969 Stewardesses, The $200,000 $25,000,000 6,150.00%

6 12/21/1937 Snow White and the Seven Dwarfs Walt Disney Co. $1,488,000 $185,000,000 6,116.40%

7 6/11/2004 Napoleon Dynamite Fox Searchlight $400,000 $45,658,577 5,607.32%

8 8/6/2004 Open Water Lion's Gate $500,000 $52,100,882 5,110.09%

9 12/15/1939 Gone with the Wind MGM/UA $3,900,000 $390,525,192 4,906.73%

10 2/8/1915 Birth of a Nation, The $110,000 $11,000,000 4,900.00%

11 10/29/2004 Saw Lion's Gate $1,200,000 $102,898,683 4,187.45%

12 10/8/2004 Primer ThinkFilm $7,000 $565,846 3,941.76%

13 6/11/1982 ET: The Extra-Terrestrial Universal $10,500,000 $792,910,554 3,675.76%

14 8/13/1997 Full Monty, The Fox Searchlight $3,500,000 $256,900,000 3,570.00%

15 5/25/1977 Star Wars 20th Century Fox $11,000,000 $797,900,000 3,526.82%

16 4/19/2002 My Big Fat Greek Wedding IFC Films $5,000,000 $353,900,000 3,439.00%

17 7/10/1998 Pi Artisan $68,000 $4,678,513 3,340.08%

18 9/26/1986 Crocodile Dundee Paramount Pictures $5,000,000 $328,000,000 3,180.00%

19 6/16/1978 Grease Paramount Pictures $6,000,000 $379,790,306 3,064.92%

20 11/16/1942 Cat People $134,000 $8,000,000 2,885.07

i found this

geisha must really suck.Biggest Money Losers, Based on Return on Investment Release Date Movie Distributor Budget Worldwide Gross Percentage Return

1 10/25/2002 All the Queen's Men Strand $15,000,000 $22,723 -99.92%

2 9/17/1999 Taxman Phaedra $3,500,000 $9,871 -99.86%

3 5/17/2002 Harvard Man Cowboy $5,500,000 $56,653 -99.48%

4 3/9/2001 Company Man Paramount Classics $12,000,000 $146,028 -99.39%

5 7/18/2003 This Thing of Ours Small Planet $2,000,000 $37,227 -99.07%

6 12/25/2000 Everlasting Piece, An DreamWorks SKG $4,000,000 $75,078 -99.06%

7 10/25/2002 All or Nothing United Artists $9,000,000 $184,255 -98.98%

8 10/26/2001 High Heels and Low Lifes Buena Vista $10,000,000 $226,792 -98.87%

9 12/9/2005 Memoirs of a Geisha Sony $85,000,000 $2,682,504 -98.42%

10 9/20/2002 Eye See You DEJ Productions $55,000,000 $1,807,990 -98.36%

11 8/4/1999 Gambler, The Legacy $3,000,000 $100,000 -98.33%

12 1/21/2000 Boondock Saints, The Indican $7,000,000 $250,000 -98.21%

13 5/4/2001 Eureka Shooting Gallery $2,000,000 $76,654 -98.08%

14 1/1/1980 Lion of the Desert $35,000,000 $1,500,000 -97.86%

15 10/11/2002 Swept Away Sony $10,000,000 $598,645 -97.01%

16 8/16/2002 Adventures of Pluto Nash, The Warner Bros. $100,000,000 $7,094,995 -96.45%

17 1/1/1978 Caravans $14,000,000 $1,000,000 -96.43%

18 2/23/2001 Monkeybone 20th Century Fox $70,000,000 $5,409,517 -96.14%

19 9/2/2005 Sound of Thunder, A Warner Bros. $80,000,000 $6,291,821 -96.07%

20 11/19/1980 Heaven's Gate United Artists $44,000,000 $3,484,331 -

This list would be more accurate, it's adjusted fopr inflation.Originally Posted by GullyFoyle

http://www.filmsite.org/boxoffice.html -

It occurs to me that, knowing the way Hollywood explains income to make it seem there is no profit to share, that this is all just a way of excusing themselves from admitting what an avaristic bunch of rich biatches they all are.

Someone made a point about acting talent, I agree, you go see a film by a top star and they are riffing same personality played in every film they make. Sort of like if you went to a concert and the musicians just played the one big hit they had, over and over. Most movies seem well worth waiting to see on cable TV.Old home videos are historical documents that may be best used to annoy your children. -

They make sure it all gets used up in "expenses". That way they don't pay taxes either.

Recommends: Kiva.org - Loans that change lives.

http://www.kiva.org/about -

We've been trekking up to PA a lot lately just this year - you guys have all the cool places!Originally Posted by thecoalman

Maybe I'd start going to the movies again if the drive-ins would come back. -

The coolest vintage drive-in I've seen is "The Spud" near Driggs Idaho, just over the pass from Jackson, Wyoming. I snapped this picture last September.

http://cinematreasures.org/theater/1742/Recommends: Kiva.org - Loans that change lives.

http://www.kiva.org/about -

It would be nice if they showed the production costs vs the overall gross.Originally Posted by thecoalman

Even so the nonadjusted list is still fairly close.

The point still remains that lower production cost films do just as well as higher production films.

And they turn a greater profit. -

I wish they still had drive-in's here in Texas around my area. I'm too young to ever have gone to one. Now there are these multi-megaplexes with stadium seats. Theaters are charging an arm-and-a-leg for admittance. Plus popcorn and snacks are usually outrageous. And you know most people still want popcorn. $3.00 for small popcorn, and $2.50 for medium drink? Talk about price gouging. Yet we can't do a damn thing to get the prices lowered. Because there will always be enough people attending the theatres, to keep them in business.

Another problem I've had with the local theaters is loud sound levels. High enough to hurt your ears, even if the movie is only 2 hours long. I've taken a sound level meter with me in a couple theaters here. Most of the time, the loudest parts of the movies were at around 100-115 decibels!!! This is damaging! Even for short periods. There is no excuse for this and I don't want my ears damaged. I contacted one of the theaters about this problem. Spoke with the manager, and he assured me that he would lower the volume immediately on all future movies. The next week I went a couple times, and sure enough the volume was lowered to around 70-80db. But it didn't last long. Someone cranked up the volume again after only a month. Makes me burning mad!!! -

Well, I think that most of us agree that:

1.) Most movies aren't worth watching at a theater.

2.) Home theater, DVD rental & sales and video games are the 2nd blow.

On the rating side, PG13 was one of the WORSE thing Hollwood / MPAA has done to hurt itself. Take a bad action, mature movie and water it down so we can get more teenagers in the theater. Now it does take an R rating to make a goodflick, but cutting it to the point where it loses its affect or quality is not helping them. So it gets bad ratings, adults won't go. The teenagers who do go and say it sucks, the adults may opt not to go either. Do the studios realize that its parents & adults who mostly pay to for moive tickets and DVD's. (Talk about shooting yourself in the foot.)

Money talks, but Hollywood is deaf.For the love of God, use hub/core labels on your Recordable Discs! -

Maryland hasn't done much to retain drive-in theaters.

We lost our last one in Harford County not too long ago.

It was pretty neat, I thought.

Had a T-style sidewalk, similar to American Graffitti - where the waiters/waitresses could roller skate your orders to your car door.

In another matter, it isn't just the internet - but cell phones - that gets the word out about whether to avoid a particular movie.

I overheard someone leaving a Regal theater this past summer open her cell phone and tell her friends not to bother with the movie she just left.Whatever doesn't kill me, merely ticks me off. (Never again a Sony consumer.) -

I've heard people open their cell phone and tell their friends not to bother with the movie, DURING the movie. That's the kind of stuff that keeps me from going to the theatre.

-

I like when they do this and leave. That's usually when the movie starts getting good. They're Loss.Originally Posted by adam

What I don't like is when you are sitting near a whiner who thinks the movie stinks and wants to make sure everyone flanking him knows his/her opinion. -

Oh she didn't leave. She kept talking, loudly. When someone told her to shutup she told him it didn't matter if she talked because the movie sucked anyway.

I ended up walking out of the movie because it did suck, with or without the crazy lady. The movie was orange county btw. -

yes, but if you'd spent five of the last six weeks there like I have you'd know that there are large areas that are so devastated there's no way to spend any money at all yet. The older wealthier neighborhoods by and large were on higher elevations and suffered less damage so the people are back and getting services back and spending and borrowing money.A New York Times analysis reveals that "well-off neighborhoods ... have received 47 percent" of the post-Katrina home loan approvals from the federal government's main disaster recovery program, while "poverty-stricken ones have gotten 7 percent."

Now let us stop the politicing (sic) before a lockdown.

Homeowners in the lower 9th are expected to commit to raising their houses up nine feet to get any federal money for re-building. In most of those areas, even the grocery stores are still closed. No people there to spend money on or loan money to.

And "home loan approvals" are not an accurate measure of total federal money spent, any more than "car loan approvals".

Now let us stop talking out our uninformed asses before a lockdown. -

@Adam I waited till video for orange county. I was glad I did.

When you go the movies usually it's fun, sometimes it's empty or maybe it's full, but occasionally the patrons are rude. -

Absolutely. The loans are through a bank of course, they'd go out of business if they approved every low income applicant and then no one would get a loan. That statistic listed above is completely out of context unless you read the article its from, which not only explains the stat but downplays it as well. As the article explains, getting denied the loan is a prerequisite for some of the federal grants. So the "poor" are not getting screwed. The "rich" are given low interest loans because they can afford to pay them back and the bank can afford to invest in them. The "poor" are given grants instead which they do not have to pay back. Besides, at the time that article was written they had only processed a fraction of the loan applications anyway.Originally Posted by kisrum

I have a friend who lost his home, but he's a professional so he's not exactly hurting too bad. He qualifies for no grants so all he can get is the low income loan which really is not much lower than a standard FHA loan. He basically has to foot the entire bill to rebuild his house. He would gladly take any grant instead.

When the site linked to is plastered with pictures of Bush with devil's horns you have to take it with a grain of salt

-

Box Office and DVD sales revenue is not an entitlement, it has to be earned like everything else in life. Plus, most hyped movies (King Kong alike) rarely raise to the occasion. For a good movie you got to look elsewhere.

-

I had this happen to me at a concert, The Trans-Siberian Orchestra. If you've nevaer seen this show it's orchestra/rock music interlaced with some poetry type stuff and a light show..... lots and lots of lights.Originally Posted by ROF

Not really my cup of tea but my GF and her daughter enjoyed it. Frankly I agreed with the guy but him and his GF were drinking and started talking about how much it sucked, then started talking about other stuff... I mean it was like they were in a bar carrying on a conversation. It's like WTF... It's not completely like a concert as I mentioned it has poetic type interludes and of course this the time they picked to continue they're converstation.....

The last straw was they started discussing sex, I pulled a George Constanza and turned around and told them to shut the hell up..... They left shortly after, I got a thank you from many of the others around us. The only thing worse than that is having a kid behind you kicking the seat...

They left shortly after, I got a thank you from many of the others around us. The only thing worse than that is having a kid behind you kicking the seat...

-

Since you didn't bother to READ the article I'll share it.Originally Posted by adam

http://www.nytimes.com/2005/12/15/national/nationalspecial/15loans.html?pagewanted=all

If you would bother to research ANYTHING you might discover that FEMA has been disproportionately offering aid to those who do not need it.Loans to Homeowners Along Gulf Coast Lag

By LESLIE EATON and RON NIXON

Hundreds of thousands of Gulf Coast families, hoping to rebuild their homes after the hurricanes using low-interest government loans, are facing high rejection rates and widespread delays at the federal agency that administers the disaster loan program.

The Small Business Administration, which runs the federal government's main disaster recovery program for both businesses and homeowners, has processed only a third of the 276,000 home loan applications it has received.

And it has rejected 82 percent of those it has reviewed, a higher percentage than in most previous disasters, saying that many would-be borrowers did not have incomes high enough, or credit ratings good enough, to qualify. The rejections came even though the Federal Emergency Management Agency has referred more than two million people, many of them with low incomes, to the S.B.A. to get the loans.

To a large degree, that high rejection rate appears to reflect a mismatch between existing government aid programs and the large number of low-income people affected by this year's hurricanes. Despite the widespread poverty in the most damaged regions, the Small Business Administration has not adjusted its creditworthiness standards, which are roughly comparable to a bank's.

In fact, the loans that have been approved appear to be flowing to wealthy neighborhoods in New Orleans but not to poor ones, according to a list of loans released by the government and mapped by The New York Times.

Under the disaster loan program, homeowners can borrow up to $200,000 at low interest rates to repair houses. Owners and renters can borrow up to $40,000 to replace damaged furnishings.

As of Tuesday, the agency had approved 17,463 home loans, for almost $1.2 billion, although only $62 million had been disbursed to homeowners, who must be ready to start repairs to get the money. More than 77,000 applications have been rejected.

The high rejection rate and the slow processing of applications are causing concern among government officials, academic experts and homeowners. Many say the problem undermines government pledges of aid, embodied by President Bush's promise in September to "do what it takes" to help citizens rebuild.

One such homeowner is Albertha Hastens, 55, a member of the school board in White Castle, La., which is between New Orleans and Baton Rouge. Strong winds damaged the roof and tore siding off her house, Ms. Hastens said, but the Small Business Administration turned her down for a loan, citing her low income. (She receives a small stipend from the school board along with her Social Security payments.)

"It makes you tired and disgusted," Ms. Hastens said of her experience with the agency. "For poor working people, you don't know what to do."

Agency officials say they are doing their best under difficult circumstances, noting that they recently approved $44 million in home and business loans in a single day.

They lay the blame for any problems on the huge size of the disaster and the small size of the agency, which has hired thousands of temporary workers to help process hurricane-related requests.

"We don't have tens of thousands of people waiting for a disaster," said Hector V. Barreto, the agency administrator. "We had 800 people. Now we have 4,200 people working, most brand new."

As for the rejection rate, agency officials say the Small Business Administration's loan program could not risk taxpayer money by lending it to people with low incomes or poor credit. "We're just dealing with the demographics in the area," said Herbert L. Mitchell, the associate administrator who runs the agency's disaster assistance program.

Both agency officials and some critics of the federal government say that many applicants do not really want loans, but must go through the agency's loan process - and be rejected - in order to be eligible for certain grants from the Federal Emergency Management Agency. (FEMA does not dispute this but says it cannot give these grants to people who have enough money to take out loans. It gives other grants for home repair in certain circumstances, but only for up to $15,600.)

The slow pace of the agency's response to the hurricanes is a reason Representative Nydia M. Velázquez of New York, who is the senior Democrat on the House Small Business Committee, called on Mr. Barreto yesterday to resign.

"We have reached a point where we need to get someone who can run the office in an effective way," Ms. Velázquez said. "He doesn't have what it takes at a moment of crisis."

In addition to the problems with the homeowners program, Ms. Velázquez cited the even slower pace of loans to businesses in the Gulf Coast States. The Small Business Administration has also allowed large corporations to get $2 billion in federal contracts under the guise of being small businesses, she said, and morale at the agency is low.

Responding to the criticism, Raul E. Cisneros, the agency's director of communications, said in a statement: "Unfortunately, the current political environment in Washington, D.C., is not lacking for individuals who are anxious to throw stones. This administration is focused on helping the people of the Gulf Coast rebuild after these devastating hurricanes."

Mr. Cisneros said the agency had passed the billion-dollar loan approval mark five weeks faster than after the hurricanes in Florida last year.

But Republicans have also been critical of the agency's response. Senator Olympia J. Snowe, the Maine Republican who is chairwoman of the Committee on Small Business and Entrepreneurship, has sharply questioned agency officials at two hearings.

Ms. Snowe also sent members of her staff to investigate the situation at the agency's loan-processing office in Fort Worth, where they found that workers have been putting in long hours but have been hampered by management missteps and a new - and, by some accounts, balky - computer system.

To get Small Business Administration loans, homeowners must submit applications and give the agency access to tax returns so loan officers can see if applicants have enough income available to cover the debt.

The agency also sends out inspectors to check the damaged homes, and makes sure that the loans are not used for costs already covered by insurance. The agency checks applicants' credit histories and, for loans over $10,000, also requires collateral, just as home mortgage lenders would.

For borrowers who could not borrow elsewhere, the interest rate is about 2.7 percent on loans that can extend for 30 years; those who do have access to other credit have to pay about 5.4 percent.

For weeks, small business organizations and government officials have been criticizing the pace of similar loans the agency makes to companies; fewer than 3,000 such loans have been approved, and roughly 800 checks have been sent out, for less than $11 million.

Housing is a crucial issue in the Gulf Coast States, where hundreds of thousands of houses were damaged and close to 170,000 were destroyed, according to the American Red Cross.

Historically, insurance proceeds, not government programs - and certainly not the Small Business Administration - contributed most of the money to rebuild houses, said Mary C. Comerio, a professor of architecture at the University of California, Berkeley, and author of a 1998 book on disaster recovery. But, Ms. Comerio added, "There is still this expectation that the government is going to do something to make people whole."

Indeed, less than 20 percent of Louisianans think that insurance should cover the costs of rebuilding, while more than 50 percent say that the federal government has the primary responsibility to pay for it, according to a survey of 653 state residents released in late November by the Public Policy Research Lab at Louisiana State University.

But for even the most fortunate victims of the hurricanes, it may take both insurance proceeds and a Small Business Administration loan to give them even a chance of rebuilding.

Craig S. Sciambra, 34, describes himself as blessed, even though his two-year-old house in the Lakeview section of New Orleans had five feet of water inside and has been declared a total loss. He still has his job as an engineer, his wife still has her job as a certified public accountant, and they had a lot of flood insurance.

Mr. Sciambra has also been approved for an S.B.A. loan and mortgage refinance. "It would be really hard to make ends meet without it," he said.

Many of Mr. Sciambra's neighbors have also been approved for such loans, according to a list of loans released by the agency and mapped by The New York Times. Well-off neighborhoods like Lakeview have received 47 percent of the loan approvals, while poverty-stricken ones have gotten 7 percent.

Middle-class black neighborhoods in the eastern part of the city have lower loan rates, too, the data suggest, at least so far.

Some residents, like Diane Fleming, 57, are in limbo. A schoolteacher who lost her home of 26 years in New Orleans East, along with most of her possessions, Ms. Fleming has been shuttling between Houston and a friend's house in New Orleans.

FEMA referred her to the Small Business Administration, which said it would not make a decision about her application until she heard from her insurance company, Ms. Fleming said.

"Meanwhile," she said, "I have no place to live."

Here is another article

http://www.thestate.com/mld/thestate/news/nation/13384880.htm

First CURSOR links to news and blog stories of the day. Obviously Adam missed that. Then again he does seem to miss quite a bit at times.FEMA reimbursements benefit higher income groups, records show

BY SALLY KESTIN, MEGAN O'MATZ AND JOHN MAINES

South Florida Sun-Sentinel

FORT LAUDERDALE, Fla. - A Hollywood surgeon got FEMA money for Hurricane Wilma for a generator.

A Plantation lawyer received $274 more from the agency than he paid for his generator.

Yet, a Fort Lauderdale teen with serious medical problems had to insert catheters by candlelight when the Oct. 24 storm knocked out power. His family couldn't afford a generator.

A FEMA program to reimburse applicants for generators and storm cleanup items has benefited middle- and upper-income Floridians the most and so far cost taxpayers more than $332 million for the past two hurricane seasons, the South Florida Sun-Sentinel found in a continuing investigation of disaster aid.

For Wilma alone, the Federal Emergency Management Agency had spent $84 million as of last Monday on generators for 101,028 people in 13 Florida counties, including Broward, Palm Beach and Miami-Dade. Another $6 million paid for chain saws for 27,394 applicants.

"I see people making $200,000 a year putting in for a rebate for a generator," Davie Fire Chief Don DiPetrillo said last month, as the town scrambled to open a shelter for people left homeless by Wilma. "This is just not a good use of public resources."

By agreement with the state, which pays 25 percent of the cost, FEMA reimburses for generators, chain saws, dehumidifiers, air purifiers and wet/dry vacuums purchased for home use after a disaster.

For the four Florida hurricanes in 2004, the reimbursements amounted to $242 million. Eighty percent of the money went to applicants in middle- and upper-income areas, including 45 residents of the moneyed island of Palm Beach and 221 people in a posh Orlando suburb with sprawling estates on lakes and fairways.

FEMA imposes no income restrictions.

"You could make $100,000 a year and still live paycheck to paycheck," said Randy Bartell, community assistance consultant with Florida's Division of Emergency Management.

FEMA leaves it up to states to choose what will be reimbursed in each disaster. States can elect to exclude certain items or limit eligibility, for instance reimbursing for generators only for the medically needy.

Other states have imposed limits, but Florida's policy remains one of the most generous of the hurricane-vulnerable states.

"It's absolutely disgusting," said David Bronstein, an insurance fraud lawyer in Plantation.

Bronstein put in a claim for a generator he bought when his Davie home lost electricity from Wilma. He said he "makes six figures" and could "certainly afford my own."

"My thought was, `Well, if I'm eligible, I'll take it because I certainly pay enough in taxes,'" he said.

Bronstein was surprised that he qualified but even more surprised when his government check arrived for $836, the maximum amount. He paid $562, including tax.

"I profited from the hurricane," he said. "It's crazy."

Dr. Arthur Palamara of Hollywood, a vascular surgeon and candidate for the state House of Representatives, got an $836 check from FEMA for a generator he bought a week after Wilma, and he now is debating whether to cash it.

"My sons are giving me a hard time, saying, `You don't really deserve the money,'" said Palamara, who lives in a home assessed at $1.1 million. "My wife says we pay taxes. It's not like we're doing anything illegal or dishonest."

Still, Palamara, a former vice president of the Florida Medical Association, wonders whether it's "morally correct."

"There are people probably who need this money more than I do," he said.

When Wilma knocked out power to Debbie Springston's Fort Lauderdale home, she begged FEMA for a generator for her 18-year-old son, Marcus, who was born with heart and kidney ailments.

"FEMA said, `Go buy a generator' and they'll reimburse us for it, but we didn't have money," she said.

Springston does not work, and the hurricane left her construction worker husband unemployed. "There was no pay coming in," she said.

Marcus uses catheters several times a day to remove bodily wastes. With no electricity, he performed the task using light from a battery-operated lamp and, when that failed, some small candles. "I could barely see," he said.

After a week, the family moved to a motel paid for by their homeowner's insurance.

"The government needs to get their priorities right," Marcus Springston said.

Dolores Morris of Hollywood, who suffers from lupus, pulmonary hypertension and diabetes, also lost power in Wilma. The 63-year-old part-time hospital computer programmer needs electricity to run a machine that feeds her oxygen. She also needs refrigeration for her insulin. Her husband, Robert, is a disabled Florida Power & Light Co. worker.

When the couple told FEMA they couldn't afford a generator, a worker suggested she go to a hospital if she ran out of oxygen. Dolores Morris said she conserved the supply she had in portable tanks and tried "not to get upset" so she wouldn't breathe too much.

"I don't think FEMA is set up for the poor person," she said.

FEMA did not respond to requests for comment on the newspaper's findings.

Federal law says disaster aid is for people unable to meet disaster-related expenses "or needs through other means." Generators are part of a miscellaneous category under which states determine items covered each time a disaster is declared.

Florida's goal is to keep people in their homes and out of public shelters. Generators help people stay comfortable and keep food cold, and chain saws are needed to cut up debris blocking access to homes, said Frank Koutnik, deputy state coordinating officer for recovery in the state Division of Emergency Management.

"You've got to show this is why I needed this chain saw, and you've got to be able to document that you were without power to be eligible for the generator," he said.

But the way the program is set up puts the poor at a disadvantage, the Sun-Sentinel found.

Other types of FEMA assistance help mostly low-income applicants. Money for home repairs or damaged belongings, for instance, is available to those who are unable to repay a loan from the Small Business Administration and have no insurance to cover the losses.

Under those programs, FEMA sends a check without the applicant paying up front. But cleanup items and generators, which can cost $500 or more, are prohibitive for people who don't have the money or credit to buy the items and wait for government reimbursement.

Koutnik said those unable to afford the purchases "would have to know a friend" who could help or make other arrangements. "The system is strictly set up as a reimbursement process," he said.

FEMA reviews claims "on a case-by-case basis" and reimburses up to the $836 for generators, according to the agency. Applicants who paid less than the maximum are reimbursed their actual cost, said spokesman Jim Homstad.

But 10 people told the Sun-Sentinel that FEMA reimbursed them for more than they paid.

FEMA officials did not respond to questions from the newspaper about the extent of overpayments or what people should do with the excess money.

The state's cost of the program for last year's four hurricanes topped $60 million. So far for Wilma, Florida is responsible for $22 million.

In Virginia, after the total tab hit just $8 million for Hurricane Isabel in 2003, officials ended the reimbursements.

"We were concerned that people who had the economic means to buy their own generator or buy their own chain saw would use that money simply because they could," said Marc LaFountain, spokesman for Virginia's department of emergency management. "We're simply trying to get the aid dollars where they're most needed and where they're going to do the most good."

Virginia officials also thought the policy sent "the wrong message," LaFountain said. "We want people to be prepared ahead of time."

North Carolina does not pay for chain saws, and only people with serious medical needs are eligible for reimbursement for generators, said Phil Myers, chief of operations for the state's division of emergency management.

Florida officials have not considered limiting their policy, Koutnik said.

"As far as we can tell, it has (worked)," he said.

In the weeks after Wilma, South Floridians flooded home improvement stores, some carrying a list of the items FEMA paid for and the reimbursement amounts, which were publicized by the media.

At Davie Boulevard and U.S. 441, Dave Fraser sold generators out of a semitrailer truck with a banner that read "FEMA Grants Available." Fraser said he sold about 200 in two days - before Fort Lauderdale police forced him out Nov. 2 because he didn't have an occupational license.

Outside Burkhard's Tractor & Equipment Inc. in Davie, almost two weeks after the storm, police directed crowds lining up to buy generators and chain saws. More than half the customers had heard about the FEMA reimbursement, owner Richard Burkhard said.

"(Some said), `I don't have a need for the saw, but if I can get reimbursed, I'm buying,'" Burkhard said. "I don't see anything wrong with that. It's there. You might as well take advantage."

In Richard Goldman's Coral Springs neighborhood, "People are treating it as one hell of a joke," Goldman said, adding that he is still waiting for a FEMA inspector to examine damage to his home. "It's a gift from FEMA."

In the upscale Idlewyld neighborhood of Fort Lauderdale, builder William Massey planned to file a claim for a generator he used to chill his wine collection. "I'll seek it because it's there," he said.

Some employees of the Sun-Sentinel also submitted claims and were reimbursed for generators or chain saws.

It will be months before the final tab is in for Wilma. The government is accepting applications through Dec. 23.

FEMA officials did not provide county breakdowns of the amounts paid so far for generators and chain saws, despite repeated requests from the newspaper.

Last year, people in all 67 Florida counties were reimbursed by FEMA for generators, the most popular item claimed. Some applicants also got money for fuel for their generators or chain saws.

The government, citing privacy concerns, refuses to identify aid recipients by name. The Sun-Sentinel analyzed reimbursements for generators and the other items from the 2004 hurricanes by ZIP code and matched the payments to income data from the U.S. Census Bureau and Claritas, a leading U.S. demographics research firm.

Statewide, $195 million went to areas with median family incomes above $41,520, defined by the federal government as the starting point of middle income in Florida. FEMA reimbursed applicants in the richest 15 percent of the state's ZIP codes $27.5 million.

In the Windermere area southwest of Orlando, home to business tycoons and celebrity athletes, 221 residents collected $177,411.

In Vero Beach on the east coast, where the town Web site says "America's cultural and corporate elite" close business deals "on a handshake during a round of golf," FEMA reimbursed 860 applicants of one ZIP code $609,777.

In Jupiter Farms, where many homes sit on an acre or more and some come with their own airstrips, half the households - 1,875 - got generators or chain saws paid for by the government. The cost: $1.5 million.

FEMA even reimbursed residents of the island of Palm Beach, a winter playground for the world's famously rich. In the island's ZIP code, 45 applicants collected $22,839.

"I don't think people of a certain income should be reimbursed," said Palm Beach councilman William J. Brooks. "I think FEMA could spend its dollars, in that particular area, elsewhere."

Yet, after Wilma, the town itself publicized the government program.

"As a resident of a county declared for FEMA Individual Assistance, you will be considered for reimbursement of a generator purchase that was made on or after the onset of the hurricane and was required because you lost power," Palm Beach's official Web site noted Nov. 3, while also announcing that beaches, tennis courts and the golf course were open.

The town decided to advise residents after "the rumor got around that FEMA was reimbursing up to $800 for generators," said Assistant Town Manager Sarah E. Hannah. "Not everybody on the island is filthy rich."

But even he should have had the capacity to click on the link to the NY Times article. I didn't see any "devil horns" there.

Nice thing about the information society you can find out what is going on in the world with a simple mouse click.

That is if one CHOOSES to. -

Just as bad was placing adult roles in the hands of children.Originally Posted by jntaylor63

There was a time you could watch a movie and an older real adult was the star. Someone with maturity.

Now it's all teenybopper's with end of their lives issues. I'm so sick of that crap.

I needed a good laugh and found this joke

Two lawyers were walking down Rodeo Drive, and saw a beatiful model walking towards them. "What a babe," one said, "I'd sure like to **** her!"

"Really?" the other responded, "Out of what?"

Similar Threads

-

Event Pan/Crop Dialogue Box Tab, revert to Dialogue Box?

By saiiyu in forum EditingReplies: 2Last Post: 10th Feb 2014, 15:26 -

Will my store-bought DTA box do the same thing as a Comcast DTA box?

By locust78 in forum DVB / IPTVReplies: 7Last Post: 25th Feb 2013, 18:26 -

Browsing hard drive DIRECTLY with Patriot Box Office

By i am x in forum Media Center PC / MediaCentersReplies: 5Last Post: 7th Jul 2011, 23:38 -

Mass conversion of Office 2003 files to Office 2007?

By Xylob the Destroyer in forum ComputerReplies: 8Last Post: 17th Jun 2008, 00:06 -

Authoring Boo Boo, Can I fix it or just remake it

By TBoneit in forum Authoring (DVD)Replies: 8Last Post: 15th Jun 2007, 12:35

Quote

Quote